Study: Online technology platforms could improve vessel utilisation levels

Online technology platforms where shipping lines and their customers can negotiate forward contracts could help improve vessel utilisation levels and reduce freight rate volatility, according to a joint study conducted by global shipping consultancy, Drewry and maritime supply chain technology provider, CyberLogitec.

While the shipping industry has changed dramatically in recent years, the market for ocean freight services remains exposed to the inherently dynamic nature of demand and fixed nature of supply which results in oscillating vessel load factors and freight rate volatility. This fundamental supply and demand mismatch causes significant structural inefficiency which adversely impacts all market participants.

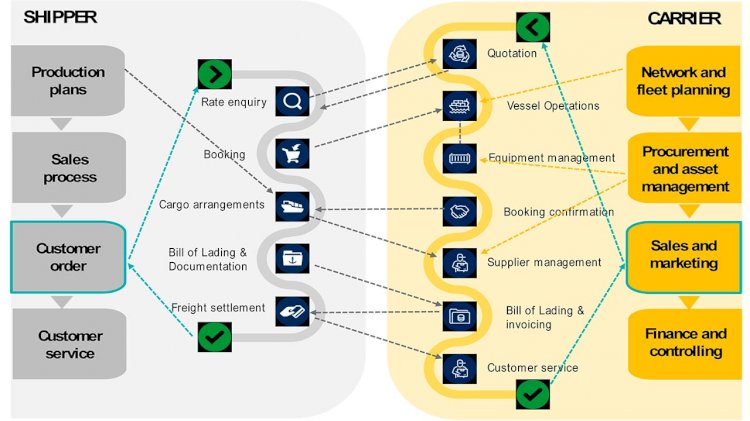

Main interactions that take place in container spot markets and where they are situated in the organisations of shippers and carriers respectively:

In this study Drewry assessed the ability of technology platforms to help reduce the fundamental mismatch between supply and demand in global liner shipping spot markets.

Philippe Salles, Head of e-Business, Transport and Supply Chain at Drewry Supply Chain Advisors, said:

“Our study concluded that many of the market’s pain points could be addressed through a capability to flexibly buy or sell ocean freight services in advance, using a neutral, global platform. Volume commitments and capacity guarantees would provide an early visualisation of demand to the market, thereby reducing the supply-demand mismatch and rate volatility, to the benefit of all market participants.”

Chris Na, VP and Head of Platform Division at CyberLogitec, said:

“As an independent market analyst with rich heritage in the global container shipping market, we approached Drewry to help define the major structural issues facing today’s container liner industry. With a clear understanding of the origin and mechanics of the problem we believe we are well placed to develop innovative and robust solutions that can benefit all market participants.”

The study identified the following end benefits resulting from technical platforms enabling the market:

- For shipping lines, forward selling of vessel slots, underpinned by volume commitments, would put them in a stronger position to forecast their revenues and reduce their cost of capital. The early visualisation of demand could also be linked to collaborative, dynamic capacity management and increase vessel load factors. The reduced freight rate volatility would assist in stabilising vessel P&L’s and improve invoice accuracy. The ability to ‘sell forward’ will provide an effective hedge against freight rate decreases.

- For shippers and forwarders, the reduction in freight rate volatility and the ability to ‘buy forward’ would protect their product margins and provide an effective hedge against freight rate increases. Together with space guarantees, enforced through a deposit scheme and vendor reliability scores, this would result in more stable and elevated service levels of their ocean providers that enable reduction of safety stock levels. Forward buying ocean freight provides procurement teams with an additional ocean freight procurement tool with flexible timings, thereby improving the agility of their logistics management teams.

- For IT providers, a platform which provides these forward negotiation capabilities would be the ideal starting point to also provide the ensuing requirements involving electronic booking, documentation, freight settlement and cargo visibility. These items combined would provide a unique position in today’s market place offering unparalleled scope and exciting opportunities to optimise their customer’s ocean freight experiences by eliminating other pain points like:

- Ambiguous freight agreements and extensive contract management efforts.

- Uncertain booking and cargo statuses.

- Unreliable contracts.

- Low documentation and invoice quality.